Most investors may find the Dow Jones Industrial Average (DJIA) confusing, yet it serves as a vital indicator of market performance. He, she, or they can gain significant insights into economic trends and investor sentiment by understanding this index. The DJIA reflects the stock performance of 30 major U.S. companies and influences investment decisions across the globe. By breaking down its components and tracking fluctuations, one can appreciate its impact on personal and financial markets.

Key Takeaways:

- The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks the stock performance of 30 large publicly owned companies in the U.S.

- Changes in the DJIA can indicate broader market trends and overall economic health, influencing investor sentiment and decision-making.

- The index is not a comprehensive reflection of the entire stock market, as it focuses on a limited number of companies across various sectors.

What is the Dow Jones Industrial Average?

Definition and Purpose

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 significant publicly traded companies in the United States. It serves as a barometer for the overall health of the U.S. economy, reflecting trends in consumer spending and investor confidence. By measuring these influential companies, the DJIA helps investors gauge market conditions and make informed decisions.

History and Development

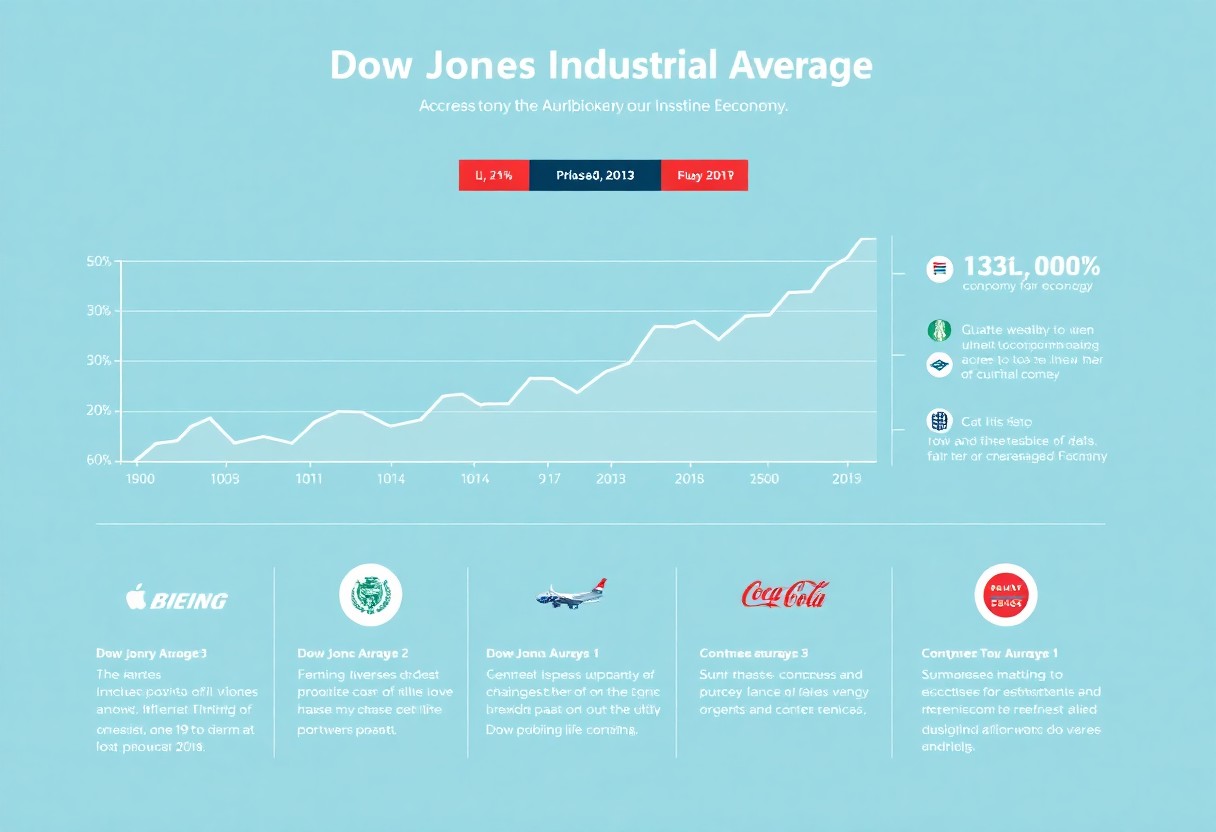

Established in 1896 by Charles Dow, the DJIA originally comprised 12 companies primarily from the industrial sector. Over time, it evolved to include a broader range of industries, with the current list featuring major corporations across various sectors. The index has undergone several adjustments, including the addition and removal of companies, but its purpose remains the same: to provide a snapshot of the U.S. economy.

In its early years, the DJI had a strong focus on industrial companies such as railroads and steel, reflecting the economic landscape of the late 19th century. The first calculation of the index was a simple average of the stock prices of its components, which has since transitioned to a price-weighted average. Today, the index includes companies like Apple, Microsoft, and Johnson & Johnson, representing diverse sectors such as technology, healthcare, and consumer goods. Throughout its history, the DJIA has faced challenges, including the Great Depression and the 2008 financial crisis, yet it has consistently recovered to reflect growth in the U.S. economy, currently standing as a symbol of financial resilience.

Components of the Dow Jones Industrial Average

The components of the Dow Jones Industrial Average consist of 30 major U.S. companies that reflect a diverse range of industries, including technology, healthcare, finance, and consumer goods. These companies are established leaders in their respective sectors, contributing to the overall market performance. As a price-weighted index, the performance of each stock influences the DJIA based on its share price, indicating how significant each company is within the index.

List of Current Companies

Among the current companies in the DJIA are household names such as Apple, Microsoft, and Coca-Cola. These corporations are recognized for their substantial market capitalization and influence on the U.S. economy. The index also includes giants like Boeing and Goldman Sachs, reflecting vital sectors like aerospace and finance, providing a broad perspective on market trends.

Influence of Company Performance

Company performance directly impacts the overall value of the DJIA, as stock price movements of individual companies contribute to the index’s fluctuations. A strong reporting quarter for a company like Apple can lead to significant gains in the index, whereas poor performance from one of the constituents could negatively affect the DJIA’s overall trajectory.

The magnitude of a company’s influence is largely determined by its stock price; thus, high-priced shares hold more sway over the DJIA. For example, during periods when Boeing faced operational challenges, the index often experienced notable declines due to its high share price, overshadowing other companies’ positive performances. Conversely, when Salesforce reported strong earnings, the positive effects rippled throughout the index, demonstrating the interconnectedness of company performance and market health. This interplay ensures that investors remain vigilant about the individual performances of these influential corporations, as they can sway the index significantly.

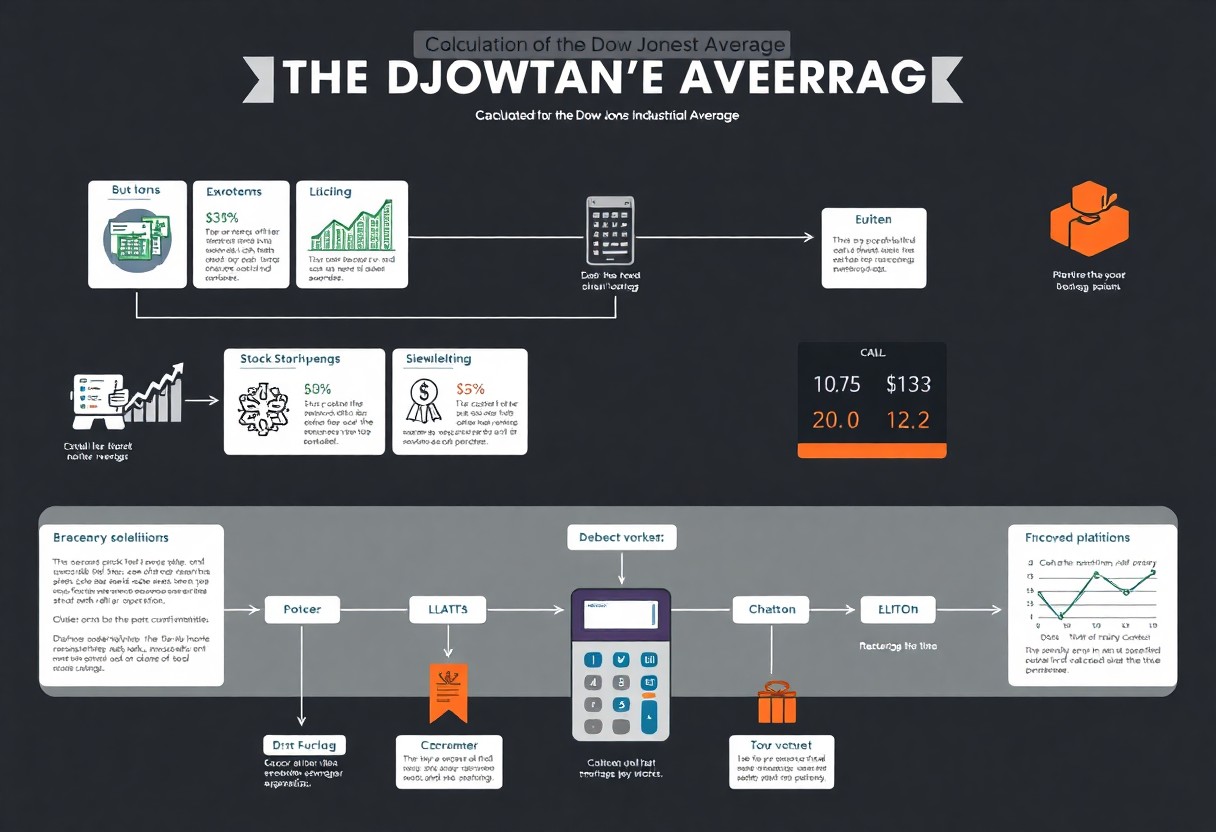

How the Dow Jones is Calculated

The calculation of the Dow Jones Industrial Average (DJIA) is quite straightforward but unique. It is a price-weighted index, meaning that companies with higher stock prices have a greater influence on the index’s movement. The total price of the 30 components is summed and divided by a specific divisor, which adjusts for stock splits and similar factors, ensuring accuracy in reflecting the market’s performance.

Price-Weighted Index Explained

A price-weighted index gives greater weight to higher-priced stocks, resulting in a disproportionate influence from a few companies. For instance, if one of the higher-priced stocks in the DJIA sees significant movement, it can sway the entire index, regardless of the overall value or performance of lower-priced stocks. This method can lead to distortions in representing market trends.

Factors Affecting the Calculation

Several factors affect the calculation of the DJIA. These include stock splits, changes in the list of components, and the adjustments made to the divisor. When a company experiences a stock split, the DJIA must adjust for this to avoid misleading fluctuations in value. Furthermore, if a component is replaced, the index recalculates using the new stock’s price.

- Stock Splits

- Changes in Components

- Adjustment of the Divisor

Adjustments to the divisor are important to maintain the index’s continuity. In the case of a stock split, for example, without adjusting the divisor, the index would reflect an unrealistic drop in value. New additions or removals of companies also necessitate recalibrating the index to keep it representative of the market. Knowing these factors is crucial for understanding the index’s stability and accuracy.

- Continuity Adjustments

- Impact of Replacements

- Market Representation

The Significance of the Dow Jones

The DJIA 101: How Does the Dow Jones Work? serves as a vital barometer of the U.S. economy, providing insights into the performance of major industries and guiding investors in their decision-making processes. Analysts often examine the DJIA to gauge overall market health, making it a key indicator for economic trends, investment strategies, and policy decisions across the country.

Economic Indicator

The DJIA is often deemed a reliable economic indicator, reflecting the performance of large cap U.S. companies and serving as a benchmark for the stock market. When the index rises, it typically signals economic growth and increased investor confidence. Conversely, a decline can indicate economic challenges ahead, influencing fiscal policy and consumer sentiment.

Market Sentiment and Investor Confidence

Market sentiment is greatly influenced by the DJIA, with its fluctuations affecting investor confidence. When the index experiences a significant rise, it tends to boost optimism among investors, encouraging increased buying activity. On the other hand, a falling DJIA can foster fear, leading to selling pressure and heightened market volatility.

Investor behavior often mirrors the movements of the DJIA; for instance, during a period of sustained growth in the index, individuals may feel encouraged to invest more, capitalizing on perceived upward momentum. Historical data, such as the DJIA’s recovery post-2008 financial crisis, illustrates how market sentiment can reverse quickly, with investors flocking back in once confidence is restored. Hence, the DJIA’s impact on sentiment and confidence plays a vital role in shaping market dynamics and investment strategies.

Understanding Market Movements

Market movements illustrate the fluctuations in stock prices influenced by numerous factors, including economic indicators, investor sentiment, and corporate performance. The Dow Jones Industrial Average reflects these movements and serves as a barometer for the broader market, impacting investment strategies and decisions among traders. As market conditions evolve, so too does the performance of its 30 constituent companies, signaling shifts in economic health and investor confidence.

Bull and Bear Markets

Bull and bear markets represent the inherent cycle of optimism and pessimism within the economy. A bull market occurs when stock prices rise consistently, fostering investor confidence and increased capital investment. Conversely, a bear market is characterized by falling prices, often accompanied by widespread fear and a hesitant investment environment. Understanding these cycles helps investors navigate their financial strategies effectively.

Global Events Impacting the Dow

Global events significantly influence the Dow Jones Industrial Average, leading to volatile market reactions. Factors such as geopolitical tensions, economic sanctions, and changes in trade policies can result in immediate shifts in stock prices. For instance, significant developments in the U.S. and China trade relationship often lead to increased volatility in the Dow, as seen during the 2018 trade war escalation, where heightened tariffs provoked considerable market fluctuations.

In addition to trade relations, global crises, such as the COVID-19 pandemic, drastically impacted the Dow, causing unprecedented declines in 2020. The pandemic not only shuttered businesses but also disrupted supply chains and triggered widespread unemployment, prompting substantial government spending and intervention to stabilize the economy. Specific declines in sectors like travel and hospitality contribute to overall market performance, making the Dow susceptible to global events that resonate across industries. Historical data demonstrates that investor reactions to these events can vary—some may view downturns as opportunities while others react with caution, further influencing the overall market trajectory.

Strategies for Investors

Investors must adopt various strategies to effectively navigate the complexities of the Dow Jones Industrial Average and capital markets. Each strategy must align with their investment goals, risk tolerance, and market conditions. By understanding the nuances of market fluctuations, they can make informed decisions that maximize returns while minimizing risks.

Long-Term vs. Short-Term Investment

They often debate the merits of long-term versus short-term investments when engaging with the Dow Jones. Long-term investors typically seek to benefit from the average’s historical upward trend over years or decades, capitalizing on compound growth. In contrast, short-term investors aim to exploit volatility for quick gains, trading frequently based on market news and trends.

Diversification and Risk Management

Diversification serves as a key strategy for managing risk within the context of investing in the Dow Jones. By spreading investments across various sectors represented in the index, investors can mitigate the impact of a downturn in any single industry. This approach not only balances potential losses but also enhances overall portfolio stability.

Effective diversification and risk management yield substantial benefits for investors targeting the Dow Jones. For instance, allocating assets across technology, healthcare, and consumer goods stocks minimizes exposure to any single sector’s downturn. During periods of economic uncertainty, this strategy proves invaluable, as evidenced by historical data indicating that diversified portfolios tend to outperform concentrated investments over the long run. Investors who utilize tools such as exchange-traded funds (ETFs) focused on the DJIA can easily achieve this diversification, thus reducing volatility while capturing the index’s overall growth.

Summing up

Upon reflecting, she recognizes that understanding the Dow Jones Industrial Average is necessary for grasping the broader dynamics of the stock market. They should note that this index serves as a barometer for economic health, influencing investment decisions and market strategies. He understands that by following simple steps to analyze the components and the historical context of the Dow, investors can better navigate market fluctuations and make informed choices that align with their financial goals.

FAQ

Q: What is the Dow Jones Industrial Average?

A: The Dow Jones Industrial Average (DJIA) is a stock market index that measures the stock performance of 30 large, publicly owned companies based in the United States. It serves as an indicator of the overall health of the stock market and the economy.

Q: How does the Dow Jones Industrial Average affect investors?

A: The DJIA affects investors by providing a benchmark for stock performance. Changes in the index can signal market trends, impacting investment decisions as investors often use it to gauge the performance of their portfolios relative to the broader market.

Q: What factors influence the Dow Jones Industrial Average?

A: The DJIA is influenced by various factors, including economic indicators like GDP growth and unemployment rates, corporate earnings reports, interest rates, and geopolitical events. These elements contribute to market sentiment and can cause fluctuations in the index.